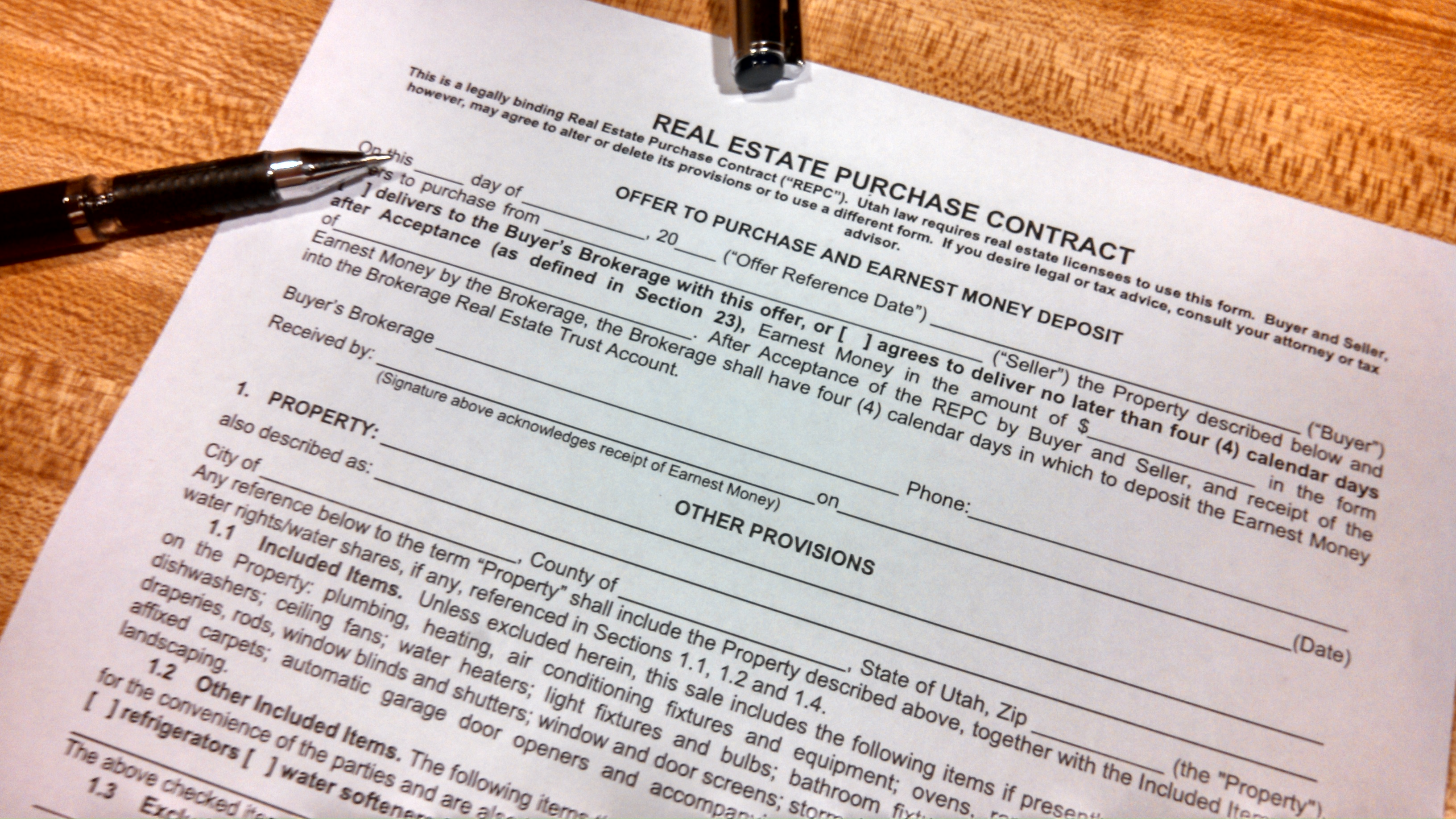

The Utah Approved Real Estate Purchase Contract, also known as a “REPC” can be downloaded or printed by clicking here.

The Utah Approved Real Estate Purchase Contract, also known as a “REPC” can be downloaded or printed by clicking here.

You can modify your REPC or make a counteroffer to a REPC with an Addendum to REPC. Such addendum can be downloaded or printed by clicking here.

Earnest Money.

A buyer can increase the the chance of acceptance by indicating to the Seller that he is backing up his offer with a valid security, or that he is “earnest.” A Seller may want to demand an increase in the earnest money if he is going to take his property off the market. Amounts are typically 1/2% to 2% of the purchase price.

Who holds the Earnest Money?

While many Sellers may deposit the earnest money in their own account, or otherwise hold the check, It is strongly advised that the parties agree on an escrow agent to deposit the money and hold onto it. The most likely candidate would be the title company which both parties may agree on to perform the closing.

While many Sellers may deposit the earnest money in their own account, or otherwise hold the check, It is strongly advised that the parties agree on an escrow agent to deposit the money and hold onto it. The most likely candidate would be the title company which both parties may agree on to perform the closing.

Typically, the Seller chooses the title company, even though the Buyer may choose another title company if he is getting a mortgage loan. Unless other circumstances warrant, the transaction is simpler if the Buyer and Seller close at the same title company. An attorney or a real estate agent can also hold earnest money in escrow. Whoever holds it, the money must be held until the transaction is closed and recorded, or until the parties agree on how it should be distributed.

Property.

As buyer, make sure that the description of the property is complete. If there is an extra sideyard or strip of land, make sure it is included. The property address is most customary, but the property Tax Serial Number is a more secure manner of identifying the property. All tax serial numbers should be included if there are more than one. If there is a water share which may or may not be included, make sure that the water share is carefully set forth.

As buyer, make sure that the description of the property is complete. If there is an extra sideyard or strip of land, make sure it is included. The property address is most customary, but the property Tax Serial Number is a more secure manner of identifying the property. All tax serial numbers should be included if there are more than one. If there is a water share which may or may not be included, make sure that the water share is carefully set forth.

Make sure that all utilities are made known and clarified what is included and what is not. For example, property in Big Cottonwood Canyon may or may not include water. There is typically more value, however, in the water share than the actual land itself. Yet there are properties on the market that do not properly disclose if water is included.

Price and Terms.

Most transactions close for cash. However, a property may sell for terms, such as cash to the mortgage in a few instances, or a seller financing transaction. If the property is sold with the existing mortgage, there are risks associated, as the due on sale clause of virtually all mortgages held by institutional lenders is triggered. you should seek legal advice here, even though there can be creative ways in which you can structure a sale which might not otherwise work out.

Most transactions close for cash. However, a property may sell for terms, such as cash to the mortgage in a few instances, or a seller financing transaction. If the property is sold with the existing mortgage, there are risks associated, as the due on sale clause of virtually all mortgages held by institutional lenders is triggered. you should seek legal advice here, even though there can be creative ways in which you can structure a sale which might not otherwise work out.

If the parties agree on Seller financing, a Trust Deed and Trust Deed Note is the most advisable document to use, rather than the less commonly used Uniform Real Estate Contract. The law which governs foreclosure of Trust Deeds is much clearer and has far less difficulty associated with it that a Uniform Real Estate Contract has.

A Utah Approved All Inclusive Trust Deed and Trust Deed Note is commonly used for this Seller financing. It “wraps around” the existing mortgage or mortgages, so a Buyer makes one payment to the Seller, and the Seller pays the underlying mortgages. The Trust Deed Note can be found by clicking here, and the All Inclusive Trust Deed by clicking here.

A Seller may justifiably want to obtain financial information on a Buyer prior to allowing Seller Financing. A form approved by the State of Utah customarily used for this Buyer financial information can be found by clicking here.

It is prudent to spell out the terms of Seller Financing on a Utah Approved Addendum for Seller Financing, which is found by clicking here.

Obtain a Title Commitment.

It is strongly advised that you obtain a title commitment, typically requested by the Seller when an offer to purchase is accepted. The title report will disclose all of the liens of the property, so the buyer can be assured of what liens need to be paid, and you can be sure of what clouds may exist on your property that you may not have known about.

It is strongly advised that you obtain a title commitment, typically requested by the Seller when an offer to purchase is accepted. The title report will disclose all of the liens of the property, so the buyer can be assured of what liens need to be paid, and you can be sure of what clouds may exist on your property that you may not have known about.

The title company you choose is or should be very helpful in answering questions about liens, and in assisting you to remove liens or clouds on the title, or obtaining payoffs of mortgages, liens, taxes and other encumbrances, in preparation for closing.

One question to always ask you title company is if there are homeowners Association fees, including fees due at closing. Some homeowner’s fees have dramatically increased in recent years, mainly due to the “newly discovered” source of revenue which developers are taking advantage of. I strongly recommend having homeowners getting together to revise the fee structure of homeowner’s associations where they are abusive, and where the terms of the covenants, conditions and restrictions which are recorded in a subdivision can be ascertained on what size of a majority and what circumstances the charges can change.

Buyer Conditions of Purchase.

The Buyer’s Conditions of Purchase provide a way where the Buyer can pull out of the purchase contract. The Buyer and Seller should exercise care in reviewing the appraisal condition and the financing condition to make sure they are acceptable, or a reasonable change accommodated.

The Buyer’s Conditions of Purchase provide a way where the Buyer can pull out of the purchase contract. The Buyer and Seller should exercise care in reviewing the appraisal condition and the financing condition to make sure they are acceptable, or a reasonable change accommodated.

Buyers who are inexperienced or apprehensive on what problems may exist with the property can choose to make the contract conditional upon their “due diligence,” where the buyer can obtain an inspection by a qualified engineer or other person of his choice.

Here, it should be noted that engineers are paid to determine whether problems exist, so they have an incentive to find problems. They may also feel liability if they do not point out problems, even when the problem may not be very serious. Valid transactions have been killed by overzealous engineers.

This Due Diligence provision of the purchase contract has an inherent serious advantage to the buyer and disadvantage to the Seller. Sellers need to be aware that a knowledgeable buyer can spring a big surprise on the Seller with a list of items the Buyer wants fixed on the property, or he can pull out of it.

The buyer has the upper hand in negotiation here, as the Seller thought that he sold the property, only to have a savvy buyer make a new list of requirements, which sometimes can be very burdensome. The Seller then has to choose to start over marketing the property all over again, or accept this new surprise burden, when the Seller thought that he had sold the property.

The buyer has the upper hand in negotiation here, as the Seller thought that he sold the property, only to have a savvy buyer make a new list of requirements, which sometimes can be very burdensome. The Seller then has to choose to start over marketing the property all over again, or accept this new surprise burden, when the Seller thought that he had sold the property.

The time for a Seller to consider the real needs of a buyer to obtain a genuine inspection for genuine purposes is at the negotiation of the purchase agreement, where a Seller can discern whether there are real needs of a buyer to obtain such an inspection rather than potential abusive tactics of a buyer who may demand additional items later. A very short period can be carefully negotiated, or the terms can be agreed to in an addendum which are very strictly construed in order to stop this kind of buyer abuse. This is one area where competent counsel who is knowledgeable about the problems of this due diligence provision can be of great help.

One last item concerning the Buyer’s conditions is that the greater number of conditions there are, and the more unreasonable such conditions may be, the weaker the actual contract is to bind the Seller to sell the property. Buyers should be therefore reasonable in their conditions to make their purchase contract binding, and Sellers also need to be aware that they also can negotiate reasonable conditions to the agreement of the sale of their property.

Seller Disclosures

Sellers are required by law to disclose any knowledge they may have regarding methamphetamines. They have no duty to disclose any stigma to a property from decontamination, or from a death in the house. While Buyers have the duty to investigate defects in real property pursuant to the doctrine of “cavaet emptor” or Buyer Beware, Sellers do have a duty to disclose some defects about which they are aware, and which are not discoverable by the buyer’s exercise of reasonable care in investigating the property.

Sellers are required by law to disclose any knowledge they may have regarding methamphetamines. They have no duty to disclose any stigma to a property from decontamination, or from a death in the house. While Buyers have the duty to investigate defects in real property pursuant to the doctrine of “cavaet emptor” or Buyer Beware, Sellers do have a duty to disclose some defects about which they are aware, and which are not discoverable by the buyer’s exercise of reasonable care in investigating the property.

A Utah Supreme Court case commonly cited for the Seller’s duty of disclosure and Buyer’s duty of investigating the property with “due diligence is Mitchell v. Christensen. This case shows the law which the Utah Supreme Court requires all lower courts in Utah to abide by in their rulings on this subject. That case can be found by clicking here.

Realtors, in both attempting to have a fair disclosure of any defects, and also in their own “CYA” exercise of caution, have developed a form listing disclosures which a Seller should make. A copy used by realtors of the Seller Disclosures can be found by clicking here.

Realtors, in both attempting to have a fair disclosure of any defects, and also in their own “CYA” exercise of caution, have developed a form listing disclosures which a Seller should make. A copy used by realtors of the Seller Disclosures can be found by clicking here.

A form used by Realtors listing items which a buyer should use as a checklist can be found by clicking here for the Buyer Due Diligence form.

Addenda to the Purchase Contract.

The Seller may respond to an offer with a Counteroffer. This is best done on an Addendum to the Real Estate Purchase Contract, which the State of Utah has set forth on a standard general Addendum form, found by clicking here. This form can be used to add additional terms to a Buyer’s first offer, as well as a Seller’s Counteroffer.

The Seller may respond to an offer with a Counteroffer. This is best done on an Addendum to the Real Estate Purchase Contract, which the State of Utah has set forth on a standard general Addendum form, found by clicking here. This form can be used to add additional terms to a Buyer’s first offer, as well as a Seller’s Counteroffer.

A common risk to children in the purchase of older homes which may predate 1978 is lead based paint which was used before this date. The United States Department of Housing and Urban Development has published a brochure explaining this risk in a helpful way. You can download this lead paint brochure by clicking here. A Lead Based paint Addendum to the Purchase Contract can be found by clicking here.

Lastly, if you need a provision allowing you to show the Purchase Contract for approval, such as your attorney or other advisor, you can use the Addendum for Third Party Approval, found by clicking here.

Lastly, if you need a provision allowing you to show the Purchase Contract for approval, such as your attorney or other advisor, you can use the Addendum for Third Party Approval, found by clicking here.